In the orderbird cashbook, you can see all your cash income as well as cash expenses, the start balance and the current wallet.

Initial setup of the cash register book

Please note that you have to set your cash payment methods on my.orderbird when starting the cashbook so that everything can work correctly. Card payments or bank transfers must NOT be recorded in the cash book. You must also enter the initial balance when you start for the first time.

Step by Step

- Open the orderbird app and tap on "Cashbook".

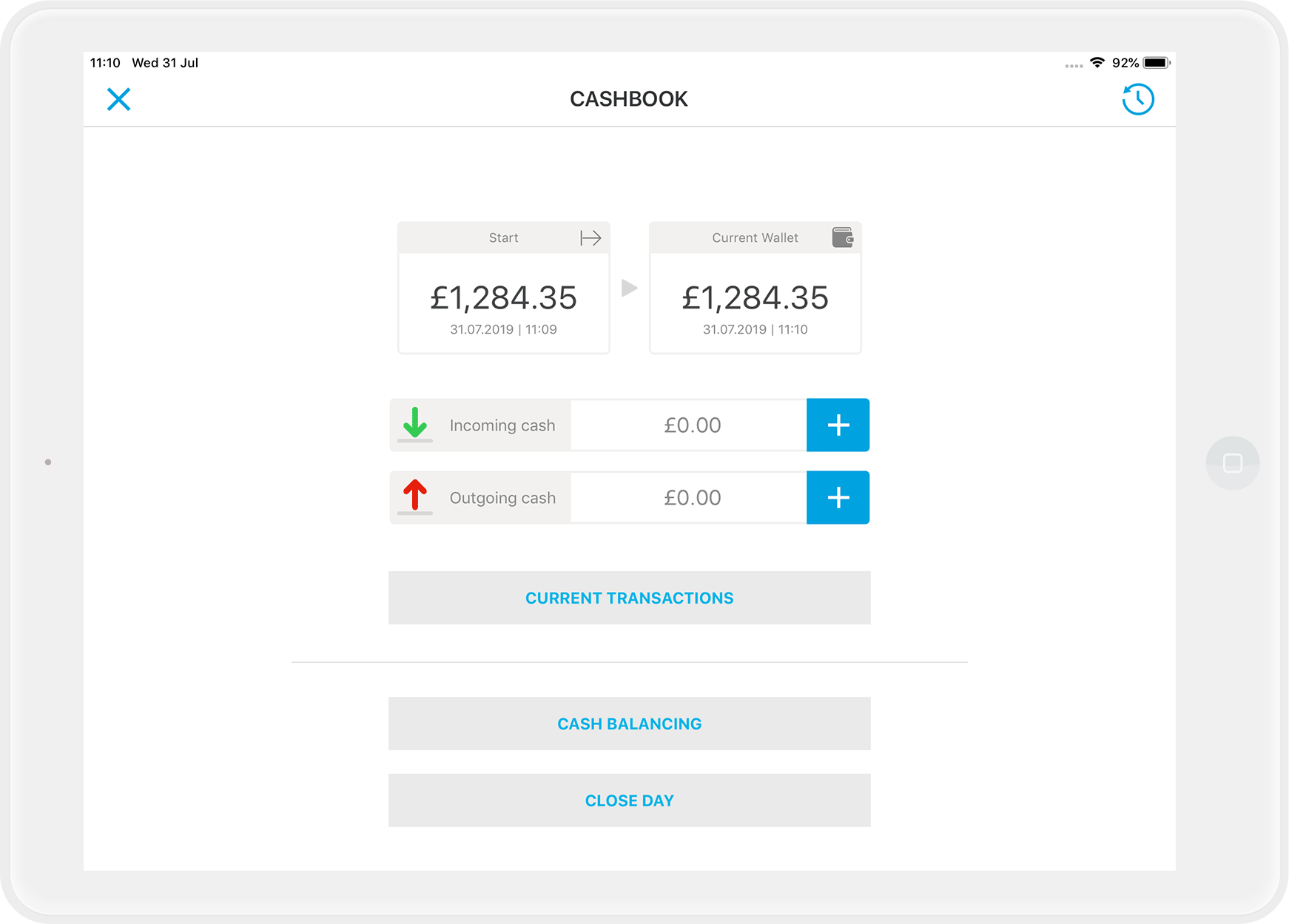

- Under "Initial balance" at the top left, you can see the cash amount you started the day with and when you recorded the first entry in the cash book - or in other words: At what time you opened the new cash sheet. To the right, you can see your current cash balance under "Current balance".

- The green arrow down marks your current cash receipts, the red arrow up marks your cash expenditures.

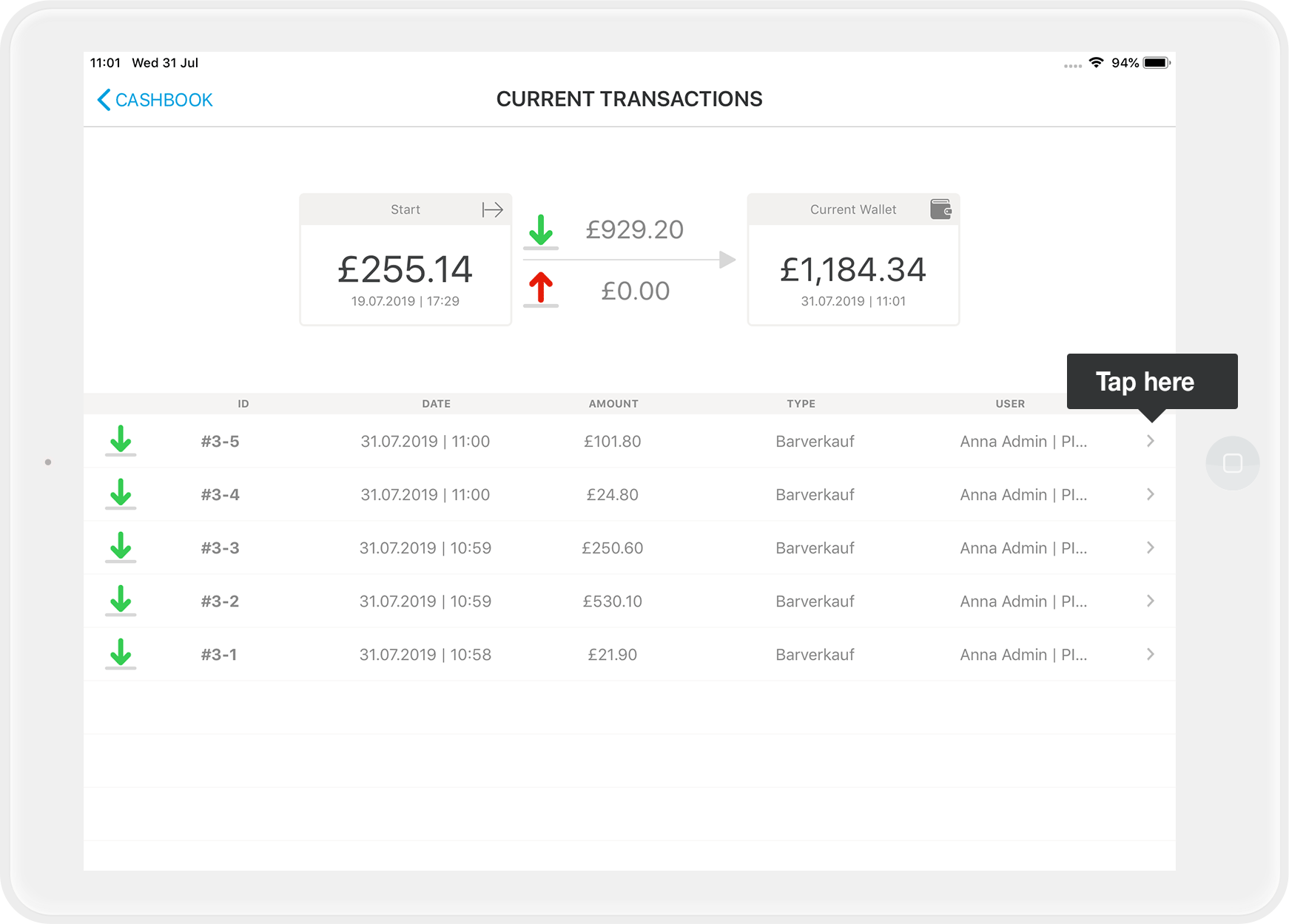

- Tap on "Current Transactions" to see a detailed list of all cash movements. Each entry has its own ID.

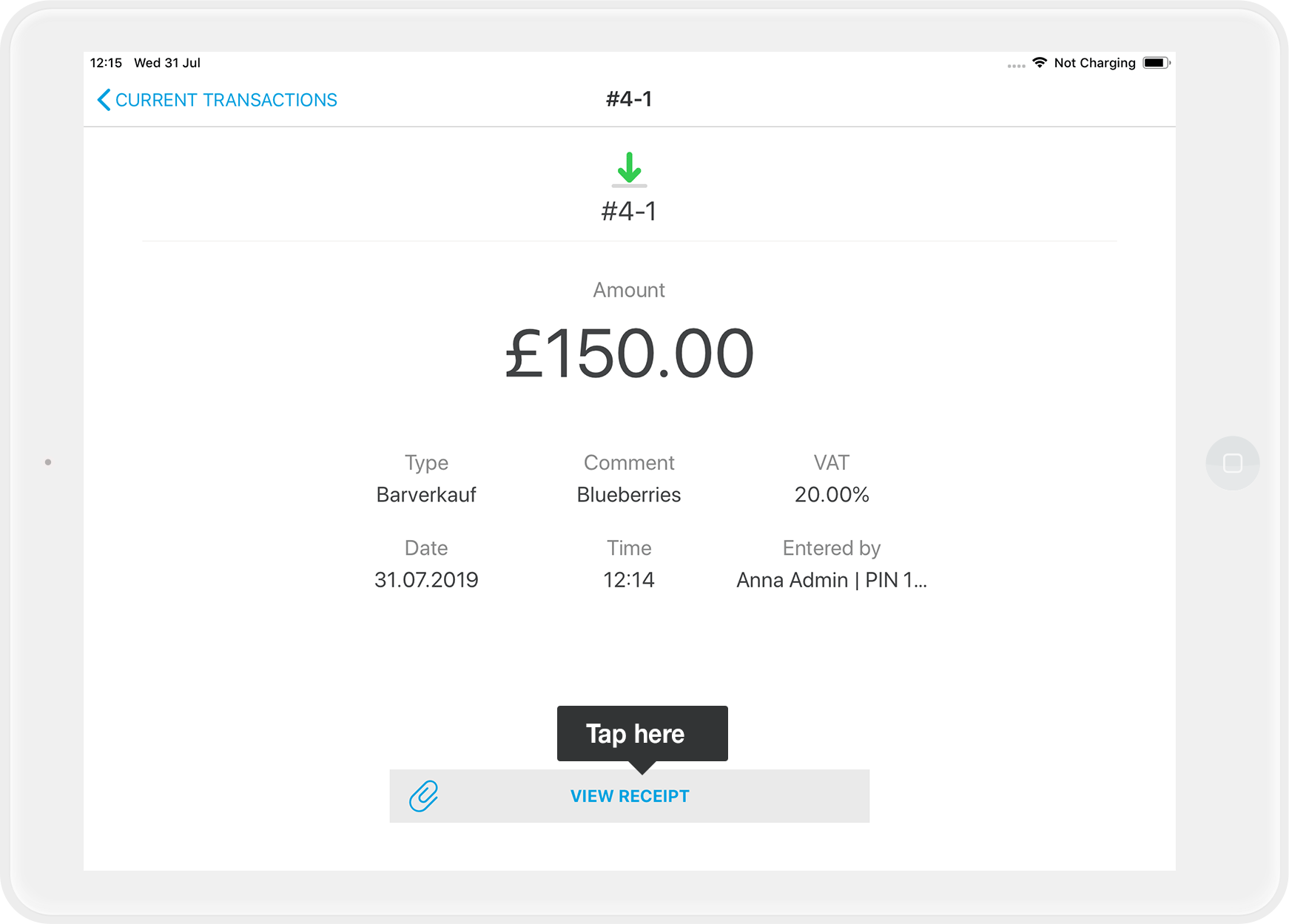

- If you tap on the small arrow on the far right of the line, you will see the digital receipt with further information:

- Tap on "View receipt" if you want to see a photo of the receipt.

Export Receipt Photos?

If you tend to misplace your original receipts often, we recommend taking receipt photos separately. How can I export my receipt photos from the cash book? This way, you’ll have a digital copy of the receipt on your iPad in the Photo Library.

Regarding Legal and Tax Advice

Regarding Legal and Tax Advice

Please note: orderbird does not provide legal or tax advice!

Everything we write reflects our experience and the experiences of our customers. Any information related to legal or tax aspects should not be considered legal or tax advice under any circumstances. Therefore, a procedure we describe may not be applicable to you or your business specifically.

For definitive statements, please consult your tax advisor. orderbird disclaims any liability for the accuracy, correctness, and completeness of the information provided here regarding tax-related procedures.